Download VAT Calculator 3 full version program free setup. VAT Calculator is a simple yet powerful tool that helps you calculate the VAT (Value Added Tax) for a given amount.

VAT Calculator 3 Overview

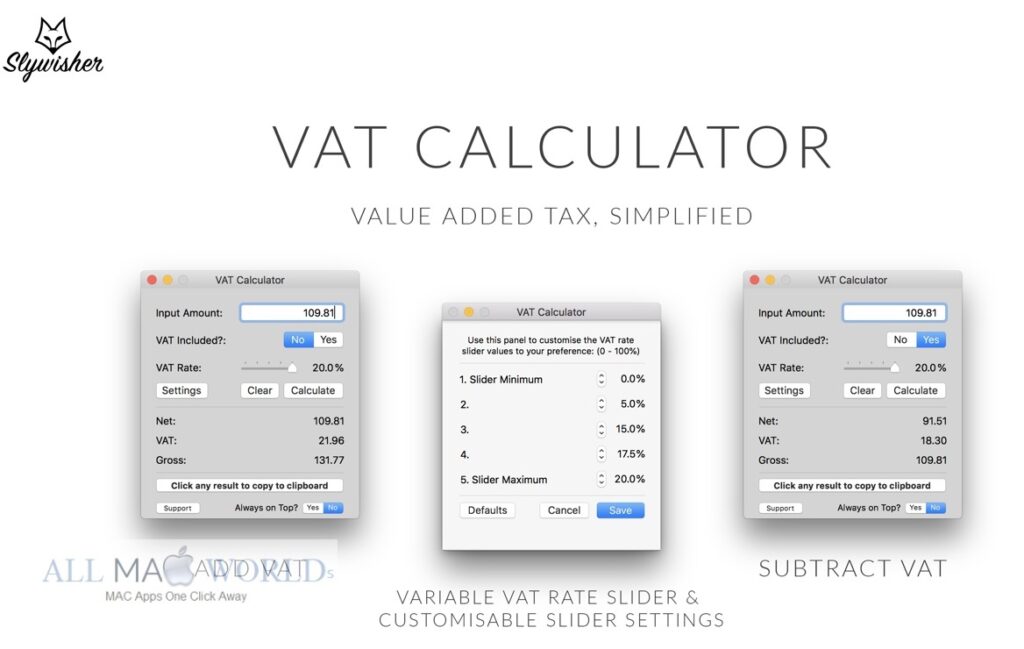

VAT Calculator is a specialized Mac Software designed to simplify Value-Added Tax (VAT) calculations and streamline financial tasks for businesses and individuals. This application provides an efficient and user-friendly solution for accurately determining VAT amounts, making it an essential tool for anyone dealing with VAT-related calculations.

At its core, VAT Calculator offers a straightforward and intuitive interface that allows users to quickly input transaction values and calculate VAT amounts with precision. Whether you’re a small business owner, accountant, or individual managing finances, this software simplifies the process of calculating VAT, eliminating the risk of errors.McAfee Endpoint Security 10

The key feature of VAT Calculator is its ability to calculate VAT amounts based on user-defined tax rates. Users can easily configure tax rates according to their specific needs and the tax regulations applicable to their region or industry. This flexibility ensures that the software adapts to various VAT scenarios, making it suitable for businesses operating in different sectors and geographic locations.

Additionally, VAT Calculator provides the convenience of reverse VAT calculations. Users can input the total amount, including VAT, and the software will deduct the VAT portion, displaying the pre-tax amount. This feature is particularly useful when users need to reverse calculate prices or determine the original value before VAT was applied.

Another essential aspect of this software is its reporting capabilities. VAT Calculator allows users to generate detailed VAT calculation reports, which can be saved, printed, or shared as needed. These reports serve as valuable documentation for accounting records, financial statements, and tax compliance.

Features

- Efficient Calculation: Streamlines the process of VAT calculation for businesses and individuals.

- Mac Software: Designed specifically for Mac users, ensuring compatibility and ease of use.

- User-Friendly Interface: Intuitive interface for quick and hassle-free VAT calculations.

- Configurable Tax Rates: Allows users to define and customize tax rates to match specific needs and regulations.

- Precision: Ensures accurate VAT amount calculations, reducing the risk of errors.

- Reverse VAT Calculation: Provides the ability to calculate pre-tax amounts based on the total amount, including VAT.

- Reporting: Generates detailed VAT calculation reports for documentation and financial records.

- Currency Conversion: Supports multiple currencies, enabling users to perform calculations in their preferred currency.

- Financial Tasks: Aids in various financial tasks, including budgeting, invoicing, and expense tracking.

- Customizable: Adapts to different VAT scenarios, making it suitable for various industries and locations.

- Tax Compliance: Assists in ensuring compliance with VAT regulations and reporting requirements.

- Accounting Records: Helps maintain accurate accounting records and financial statements.

- Business Use: Ideal for small businesses and large enterprises managing VAT-related tasks.

- Individuals: Useful for individuals dealing with personal finances and tax calculations.

- Error Reduction: Minimizes the risk of calculation errors, promoting financial accuracy.

- Documentation: Provides essential documentation through detailed VAT calculation reports.

- Financial Statements: Supports the creation of financial statements with accurate VAT data.

- International Trade: Benefits businesses involved in international trade with currency conversion capabilities.

- Precise Financial Planning: Facilitates precise financial planning and forecasting with accurate VAT calculations.

- Streamlined Workflow: Improves workflow efficiency by simplifying VAT-related tasks.

Technical Details

- Mac Software Full Name: VAT Calculator for macOS

- Version: 3.7

- Setup App File Name: VAT-Calculator-3.7.dmg

- File Extension: DMG

- Full Application Size: 2 MB

- Setup Type: Offline Installer / Full Standalone Setup DMG Package

- Compatibility Architecture: Apple-Intel Architecture

- Latest Version Release Added On: 10 October 2023

- License Type: Full Premium Pro Version

- Developers Homepage: Slywisher

System Requirements of VAT Calculator for Mac

- OS: Mac OS 10.7 or above

- RAM: 2 GB

- HDD: 500 MB of free hard drive space

- CPU: 64-bit

- Monitor: 1280×1024 monitor resolution

What is the Latest Version of the VAT Calculator?

The latest version of the VAT Calculator is 3.7.

What is VAT Calculator used for?

VAT Calculator is a tool used to calculate the Value Added Tax (VAT) of a product or service. VAT is a tax that is added to the price of goods and services in many countries around the world. It is a tax on the value that is added at each stage of production and distribution of a product or service. The VAT rate varies from country to country and may also depend on the type of product or service being sold.

VAT Calculator is used by businesses and individuals to calculate the amount of VAT that they need to pay or charge. It is an important tool for businesses to keep track of their VAT liability and to ensure that they are complying with tax regulations. VAT Calculator can also be used by consumers to calculate the amount of VAT that they will need to pay on a product or service.

VAT Calculator can be used online or as a mobile app. It is compatible with most devices and operating systems. Some VAT Calculator tools also include additional features, such as currency conversion and the ability to calculate discounts or markups.

What is VAT Calculator compatible with?

VAT Calculator is compatible with a variety of devices and platforms, including:

- Desktop computers running macOS operating systems

- Web browsers, including Google Chrome, Mozilla Firefox, Microsoft Edge, and Safari

It is also compatible with different languages and currencies, making it useful for people in various countries around the world.

What are the alternatives to VAT Calculator?

There are many alternatives to VAT Calculator that perform similar functions, including:

- TaxJar: TaxJar is an automated sales tax software that offers a VAT calculator as part of its suite of tools. It is designed for e-commerce businesses and can help calculate VAT and other sales taxes for multiple jurisdictions.

- Avalara: Avalara is another sales tax software that offers VAT calculation as part of its services. It is a cloud-based platform that is designed to help businesses automate their tax compliance processes.

- HMRC VAT Calculator: The HMRC VAT Calculator is a free online tool offered by the UK government that helps businesses and individuals calculate VAT. It is a simple calculator that is designed for use by anyone who needs to calculate VAT.

- Taxamo: Taxamo is a cloud-based platform that provides VAT calculation and compliance services for e-commerce businesses. It offers a range of tools to help businesses automate their VAT compliance processes.

- TaxCalc: TaxCalc is a UK-based software provider that offers a range of tax-related software tools, including a VAT calculator. It is designed to be used by accountants and other tax professionals to help their clients with VAT compliance.

- Vertex: Vertex is a cloud-based tax compliance software provider that offers a range of VAT calculation and compliance tools. It is designed for businesses of all sizes and offers automated tax compliance processes to help businesses stay compliant with VAT regulations.

These alternatives vary in terms of features, pricing, and ease of use. It’s important to evaluate each one based on your specific business needs and requirements before making a decision.

Is VAT Calculator Safe?

In general, it’s important to be cautious when downloading and using apps, especially those from unknown sources. Before downloading an app, you should research the app and the developer to make sure it is reputable and safe to use. You should also read reviews from other users and check the permissions the app requests. It’s also a good idea to use antivirus software to scan your device for any potential threats. Overall, it’s important to exercise caution when downloading and using apps to ensure the safety and security of your device and personal information. If you have specific concerns about an app, it’s best to consult with a trusted technology expert or security professional.

Download VAT Calculator Latest Version Free

Click on the button given below to download VAT Calculator free setup. It is a complete offline setup of VAT Calculator macOS with a single click download link.

AllMacWorlds Mac Apps One Click Away

AllMacWorlds Mac Apps One Click Away